About Probable Turnover

How quickly a firm operates its operations is determined by the accounting concept of turnover. The most common way to gauge how quickly a company sells its merchandise or collects money from accounts receivable is through turnover. Examples of often occurring types of turnover are accounts receivable turnover, inventory turnover, portfolio turnover, and working capital turnover.

By examining a variety of these ratios, businesses can more accurately gauge the effectiveness of their operations, frequently with the intention of increasing turnover. Turnover is a term used in the investing industry to describe the proportion of a portfolio that is sold in a given month or year.

When the turnover rate is high, the commissions paid to brokers for transactions are higher. One of a company’s major assets is its inventory, followed by accounts receivable. Both of these accounts demand a large monetary outlay, so it’s crucial to gauge how quickly a company can raise money. Turnover ratios determine how quickly a company receives cash from its investments in accounts receivable and inventories.

Fundamental analysts and investors use these statistics to assess a company’s investment potential. Accounts receivable and inventory are two of a company’s biggest assets. Both of these accounts demand a large monetary outlay, so it’s crucial to gauge how quickly a company can raise money.

Turnover ratios determine how quickly a company receives cash from its investments in accounts receivable and inventories. Fundamental analysts and investors use these statistics to assess a company’s investment potential.

Key Takeaways

- How quickly a firm operates its operations is determined by the accounting concept of turnover.

- The ratios involving accounts receivable and inventories are used in the most popular measurements of corporate turnover. These are known as inventory turnover and accounts receivable turnover, respectively.

- Accounts receivable turnover reveals how rapidly money is being paid in relation to credit sales throughout a given time frame, such as a month or a year.

- Inventory turnover, which measures how quickly a company sells its inventory during a specific time period, is calculated by dividing the cost of goods sold (COGS) by the average inventory.

- Turnover is a term used in the investing industry to describe the proportion of a portfolio that is sold in a given month or year.

Turnover in business and its importance

One could argue that net profit, which accounts for things like tax and administrative costs in addition to the cost of products and services, is the greatest way to gauge financial success properly and that turnover only tells part of the story.

Turnover, however, is crucial as a base number to work with when figuring out how to fulfill profit targets as well as when trying to attract investors. It’s an excellent number to use when comparing it to other measures.

For instance, it could be time to look into ways to reduce your sales costs if your gross profit is low relative to your turnover. If, on the other hand, your net profit is low in relation to your revenue, you should consider improving the financial performance of your company.

Turnover covers all costs paid by the consumer, including delivery costs, in addition to the price of a good or service (less any applicable VAT, of course). Before subtracting any fees or commissions, turnover should also be computed.

This is critical since you’ll need to know your precise turnover amount for your tax return and when you apply for VAT. Because if you calculate your turnover incorrectly, you may believe you don’t need to register when in fact you must, which could find you in legal trouble.

Also keep in mind that turnover must be reported starting from the time the sale is made, not from the time the invoice is sent or the money is received. This is something that smaller firms frequently fall victim to.

Fundamentals of Turnover

One of a company’s most important assets is its inventory, followed by accounts receivable. Because both of these accounts require a sizable monetary outlay, it’s crucial to monitor how quickly a business receives the money.

Turnover ratios gauge how soon a business receives cash from its investments in accounts receivable and inventories. These figures are used by fundamental analysts and investors to determine whether a company is a good investment.

Significance of Turnover

One could argue that because net profit also accounts for ancillary expenses like taxes and administrative fees, it provides a more accurate picture of financial success than turnover, which only tells part of the story.

On the other side, turnover is a crucial starting point for both enticing investors and figuring out how to achieve profit targets. It’s a helpful number to use when comparing it to other numbers. Consider measures to lower your sales costs if, for instance, your gross profit is low in comparison to your turnover.

On the other hand, you should think about improving your company’s financial efficiency if your net profit is poor in comparison to your turnover.

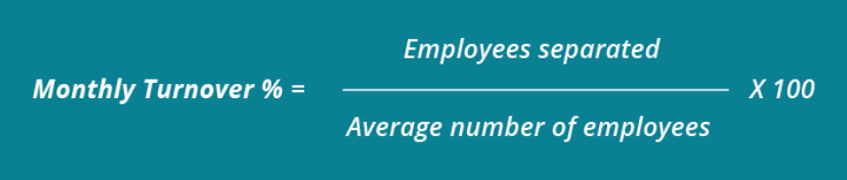

Calculate Employee Turnover

- There is currently no “correct” technique to calculate turnover, as people who are knowledgeable about the subject may well know. A fast Google search will turn up numerous websites that use various formulas. Similar things take place at professional bodies.

The International Organization for Standardization (ISO) employs one definition, whereas the American National Standards Institute (ANSI), an organization dedicated to fostering consensus standards, adopts another (ISO).

The turnover formula suggested by ISO is likewise rather ambiguous and can be calculated (and thusly interpreted) in a number of different ways. It is understandable why HR professionals should be perplexed about this issue, despite the technical challenges involved in determining the overall number of employees and those who have left.

- Employee: According to ANSI, a person who “received any payroll payment during the pay period that includes the 12th day of the month” is considered an employee. An Employee cannot be a new Hire, as will be discussed in more detail in the section after this one.

- Turnover: Dismissal, attrition, and other reasons for leaving the company. The following pay month will not include these employees on the payroll.

- Turnover rate: the proportion of workers that quit during a specific time period.

This emphasizes how crucial it is to distinguish clearly between employees, hires, and terminations. There are three distinct groupings here, and there are three distinct measures. People who were hired during the specified time frame should be treated as such since a different set of metrics is in place just for them.

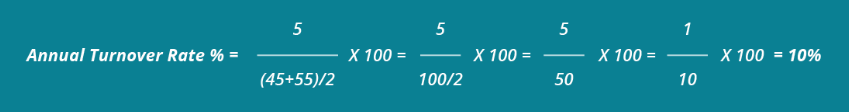

The hiring rate for the time period includes hires as an example of this. If an employee leaves early, they are counted in the 90-day turnover measure as well as the first-year turnover rate. Therefore, we need to distinguish clearly between our hires and employees. Looking back at the data from our example, we can see that there were 100 employees, five terminations, and ten new hires. Due to the fact that five out of every 100 employees departed the organization, the turnover in our example above was 5%.

This strategy is consistent with the explanation provided in ISO 30414, a global standard for Human Capital Reporting established in 2018, which divides the total number of departing employees over a specified period by the total employee population of the firm.

Advantages of Turnover

- It serves as a gauge of an entity’s capacity for profit. It takes into account overall profits depending on the number of things sold and the advertised selling price. The annual turnover reveals a company’s market power and how well-liked it is by its clients.

- It is a periodic sum that depicts the turnover throughout the fiscal year, or the calendar, depending on the situation. It is a consistent figure, and consistency can be preserved for various commercial goals.

- The yearly turnover amount is useful for comparison. The yearly turnover statistic can be compared by a company with the previous financial year or calendar year, as appropriate, because it is a periodic figure. Or, depending on the situation, it might be contrasted with the yearly turnover of another product during the same fiscal year calendar.

- It is also possible to utilize an annual turnover figure to keep the businesses competitive. This number for a certain company for a specific year can be compared to the same product for another company in this place. Actions should be taken to equal or surpass the competitor firm’s annual turnover.

- The amount achieved after subtracting various expenses, both direct and indirect, and adding indirect and non-operating incomes to the annual turnover figure is the company’s net profit. However, it is clear that the net profit figure is sometimes deceptive and does not accurately depict the company.

- When the company’s primary business is another product, it occasionally generates irregular indirect income like speculative profit. Therefore, even though the net profit can be quite high, this is an inaccurate reflection. Thus, it accurately depicts the amount by which the company has established a market base.

Frequently Asked Questions

Employee retention rates of 90% or more are typically seen as strong, and in order to maintain a stable workforce, a business should strive for a turnover rate of 10% or less.

A position with a high turnover rate raises serious red flags about the company’s culture or, more especially, the difficulty of working with the position’s boss.

Staff turnover is a crucial indicator of the efficiency of a program’s or organization’s overall management as well as the success of its human resources management system. It offers a supplementary measurement to the earlier indicator of filled important posts.